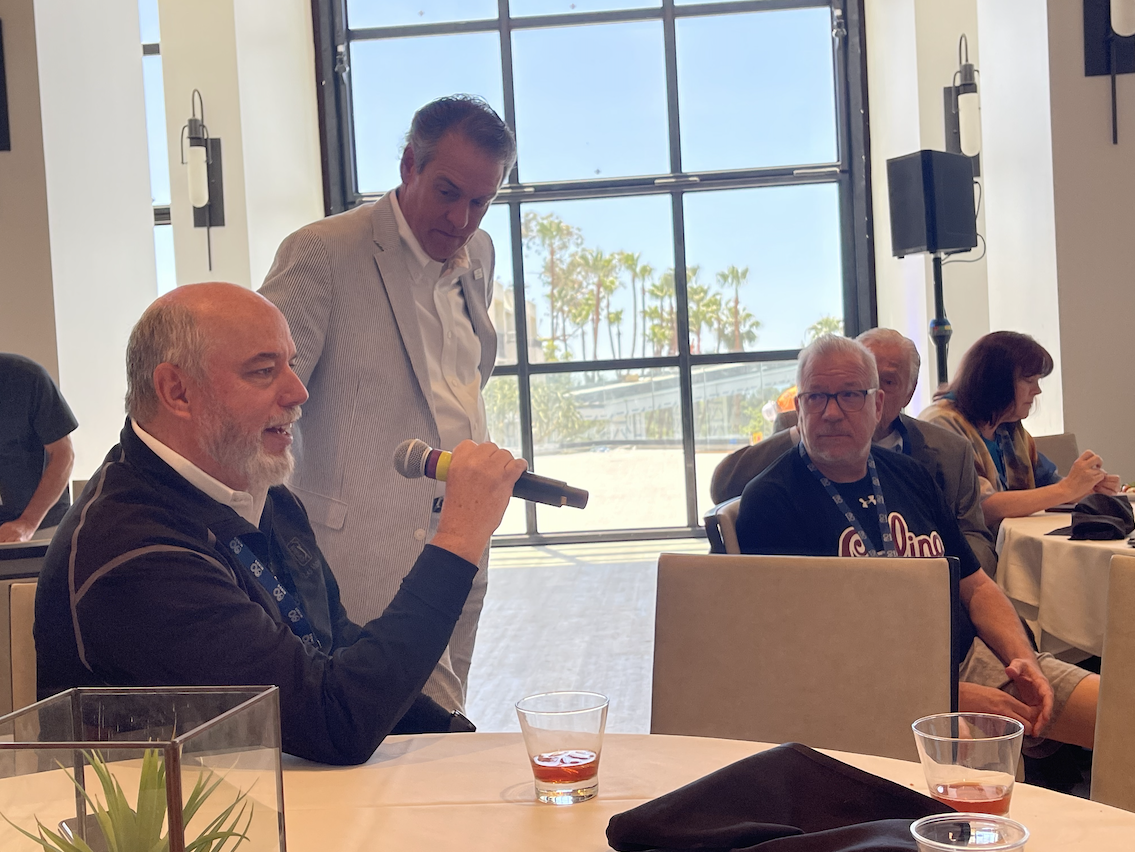

Ron and Ed welcomed the CATO Institute's director of economics and trade policy studies, Scott Lincicome. Scott writes on international and domestic economic issues, including international trade; subsidies and industrial policy; manufacturing and global supply chains; and economic dynamism.

A bit more about Scott Lincicome…

In addition, to his work at CATO, Lincicome also is a senior visiting lecturer at Duke University Law School, where he has taught a course on international trade law, and he previously taught international trade policy as a visiting lecturer at Duke. Prior to joining Cato, Lincicome spent two decades practicing international trade law at White & Case LLP, where he litigated national and multilateral trade disputes and advised multinational corporations on how to optimize their transactions and business practices consistent with global trade rules and national regulations. From 1998 to 2001, Lincicome was a trade policy research assistant at Cato; he became an adjunct scholar in 2013. During that time, Lincicome authored or coauthored several policy papers, as well as numerous op-?eds on trade and economic issues. He is routinely featured on TV, radio, and print media. Lincicome has a BA in political science from the University of Virginia and a JD from the university’s School of Law.

Use these show notes to follow along with the audio…

Segment one:

Not only is Scott’s article, The (Updated) Case for Free Trade, fun to read it also LOOKS great. Seriously. Click/tap this link and check it out. https://www.cato.org/policy-analysis/updated-case-free-trade

Government’s don’t trade. People do. Giving the credit to government is the number one fallacy when it comes to trade.

Scott says, “Trade is two people wanting to do business together for their own mutual benefit.” How is that for straightforward and simple?

Comparative advantage is counterintuitive. In any trading relationship, the parties gain more by cooperating in all circumstances. Even in situations where one party might have an absolute advantage. https://en.wikipedia.org/wiki/Comparative_advantage

WRT Comparative Advantage: The US is the second largest manufacturer in the world. However, the US is focused on high value goods like satellites and weaponry. This leaves the US to trade for lower value goods such as textiles or footwear (as examples).

Segment two:

Protectionism has a LOOOOONG history in the United States and Scott Lincicome wrote a great piece on it. “Doomed to Repeat It: The Long History of America’s Protectionist Failures” https://www.cato.org/policy-analysis/doomed-repeat-it-long-history-americas-protectionist-failures

Unfortunately, voters do not vote on trade. The benefits are diffuse and hard to individually quantify. Voters tend to take their queues from political leadership which helps to explain the flip-flopping of free trade positions across US parties over the years.

What a brilliant guest today! Scott discussed the Inflation Reduction Act of 2022 recently on The Dispatch podcast https://www.cato.org/multimedia/media-highlights-radio/scott-lincicome-discusses-inflation-reduction-act-2022-dispatch

In support of free trade, did you know that more than half of everything we import are capital goods used by manufacturers who then turn around and make things here in the United States? Many think it is just iPhones and t-shirts but that is not the case.

Segment three:

Is there a case for trade restrictions with China based on their human rights record? US law already restricts trade on the grounds of slave labor.

We asked Scott today, why is it that the US is the largest exporter of liquid natural gas but Puerto Rico buys it from Trinidad? Answer: The Jones Act. Start educating yourself with this article from @CATOInstitute https://www.cato.org/publications/policy-analysis/jones-act-burden-america-can-no-longer-bear

The Jones Act hurts Puerto Rico, Alaska, and Hawaii the most but it doesn’t stop there. https://www.cato.org/project-jones-act-reform @CATOInstitute #EndTheJonesAct

Segment four:

The Foreign Dredge Act is basically an extension of The Jones Act and that’s part of the reason that America’s ports problem is decades in the making. Which is a great title for one of Scott’s articles @CATOInstitute https://www.cato.org/commentary/americas-ports-problem-decades-making #EndTheJonesAct

…AND cabotage laws are comparable to The Foreign Dredge Act and The Jones Act. Scott wrote an article about your summer cruise and why it got cabotaged. https://www.cato.org/commentary/summer-cruise-just-got-cabotaged

“The Chips Act is about 5 times too big.” Scott let us know today that it includes funding for chip facilities at the low end and also includes funding for chip factories that were already planned in the United States.

A big THANK YOU to Scott Lincicome for joining us today. Check out his INSIGHTFUL free trade article on the @CATOInstitute website. Is it smart and also features a truly beautiful design. https://www.cato.org/policy-analysis/updated-case-free-trade

Bonus Content is Available As Well

Did you know that each week after our live show, Ron and Ed take to the microphone for a bonus show? Typically, this bonus show is an extension of the live show topic (sometimes even with the same guest) and a few other pieces of news, current events, or things that have caught our attention.

This past week was bonus episode 408 - Princeton and Tuition

Here are a few links Ron and Ed discussed on the bonus episode:

Princeton Will Cover Tuition Costs for Families Making Under $100,000

Martha’s Vineyard Humanitarian Crisis, Gov activates National Guard

Scientists are using AI to dream up revolutionary new proteins

Google Deepmind Researcher Co-Authors Paper Saying AI Will Eliminate Humanity

California first US state to begin ranking extreme heat wave events

Click the “FANATIC” image to learn more about pricing and member benefits.